Credit Karma Narratives

Transformed the overview screen. Fundamentally changed how people experience the product through dynamic content and how partner teams create member value.

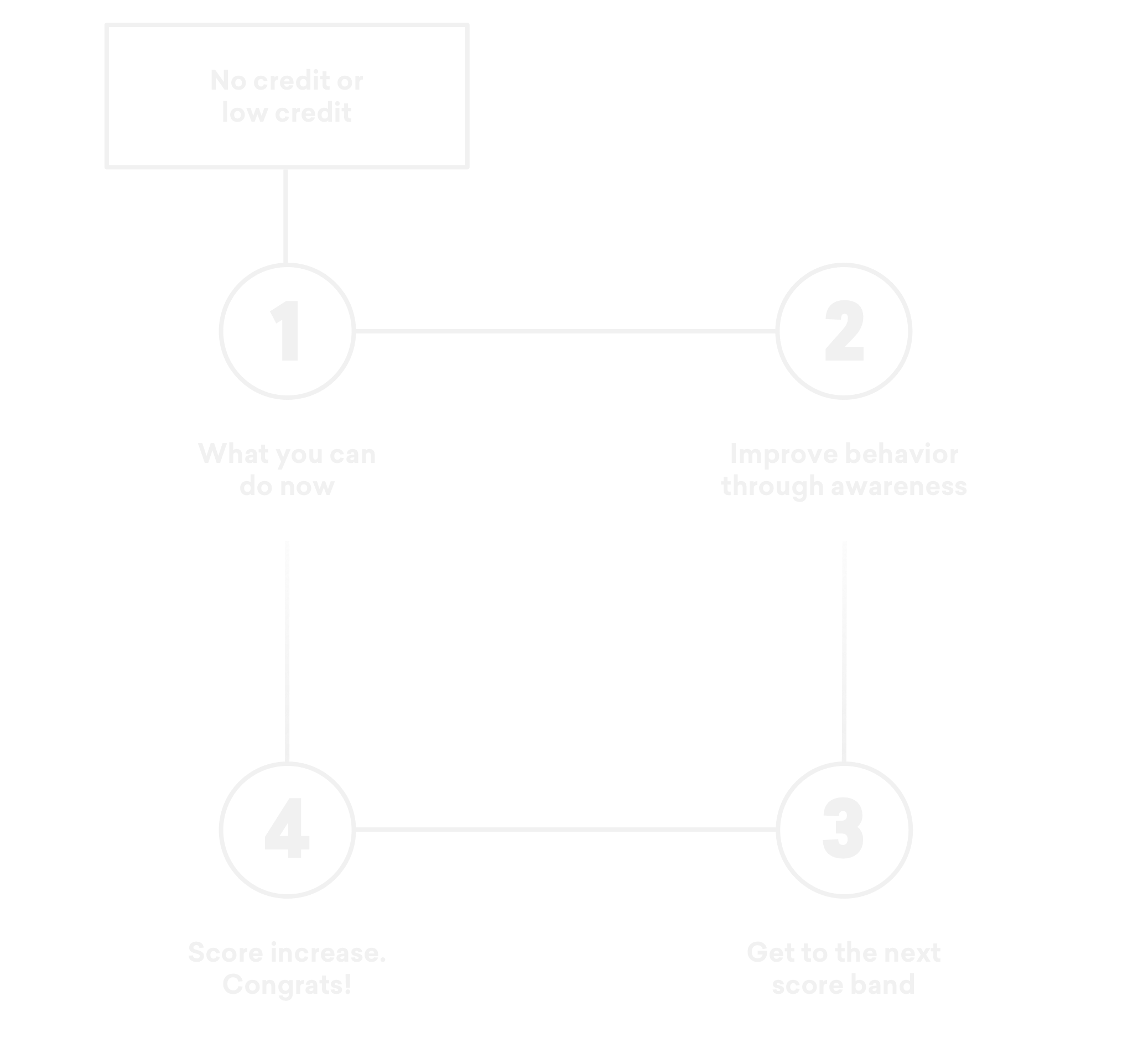

Everyone loves a good story. We're hard wired to think of products in terms of narratives. When you look at a particular customer journey there is usually a beginning, middle and an end. The narrative arc can easily be applied to obstacles people need to overcome and correlations can be drawn between rising actions, inciting incidents, crisis and resolution and someone improving their credit. In the center of the story is the heroine who has a challenge to conquer in order for her to make financial progress.

Problems in someone's financial universe can arise from something material like deliquent payments, collections, crippling credit card debt, unemployment, student loans or medical bills. Credit issues can also come from less tangible sources like bad money management, poor spending habits, lack of awareness or understanding of how financial systems work. Banks and financial institutions have a huge advantage.

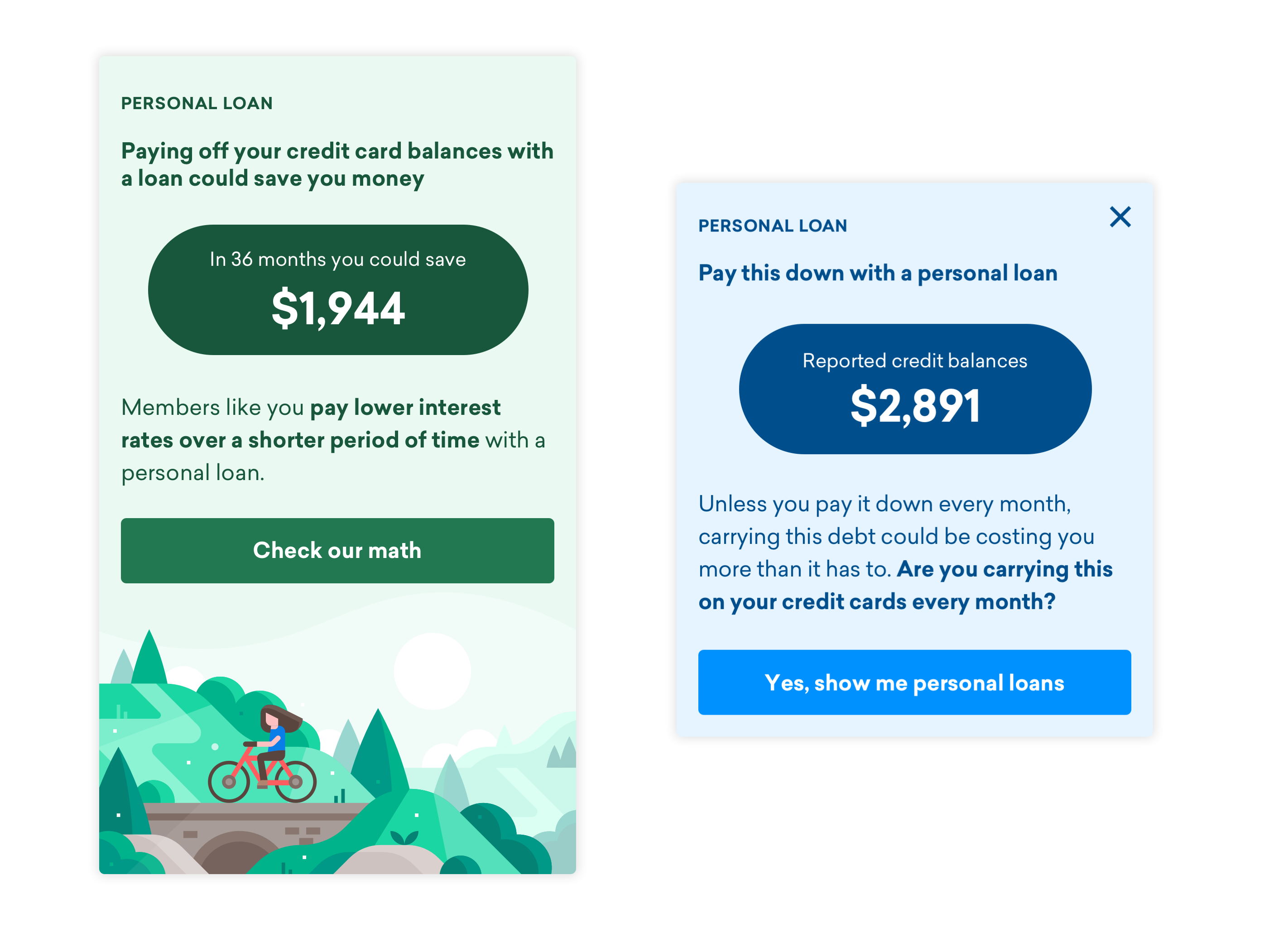

Obstacles can compound quickly—too many credit cards with high interest rates is a good case in point. Credit is viewed as an important part of someone's ability to borrow money. Your credit score speaks to your record of payments and acts as a probable indicator of how likely you would be to pay back debts borrowed in the future.

The relationship between credit and debt can be confusing. How to improve your credit and manage bad debt can be unclear. For instance, making consistent payments on long-standing debt can improve your score in the short term but actually paying off the same debt and closing the account can bring your score down. To make matters worse there are also different types of debt. You have consumer debt, on the one hand, things like credit card debt or student loans that you make payments on and carry month to month. This type of debt is common and when in good standing can improve your score as long as you’re able to pay the balance at the end of the month.

You may have a mortgage which can account for a large amount of one’s debt, possibly several hundreds of thousands of dollars. You might think of a mortgage as debt because you borrowed the money and make monthly payments, but your home is actually an asset. If the market is right you could sell it and trade in the debt on your home for actual currency.

The factors affecting your credit are even more cryptic. Things like age of credit, credit history, inquiries, credit usage, amount of debt and derogatory marks all add up to your rating. Making heads or tails of this can be complicated.

In order to serve Credit Karma members best we extended the surface and schema on the overview screen where we could have new kinds of conversations. The majority of people (over 50%) said they came to the app to check their score and understand the factors impacting their credit. Users were less familiar with how things like credit card usage, missed payments or collections affected their credit and what they could do with their score once it improved. Alternatively, people with good or excellent scores expected Credit Karma to tell them when it was time to refinance.

The previous version of the app's dashboard did a poor job of highlighting events that hurt people's score and the factors impacting their credit. The app didn't communicate the expanded capabilities of the product or brand. It treated every user exactly the same, whether you had good credit and were looking to buy a home or you were still working on improving your score. New features weren't inherently discoverable. The overview screen was a zero sum game where anytime you added something new, a new feature or product offering, it took attention away from something else.

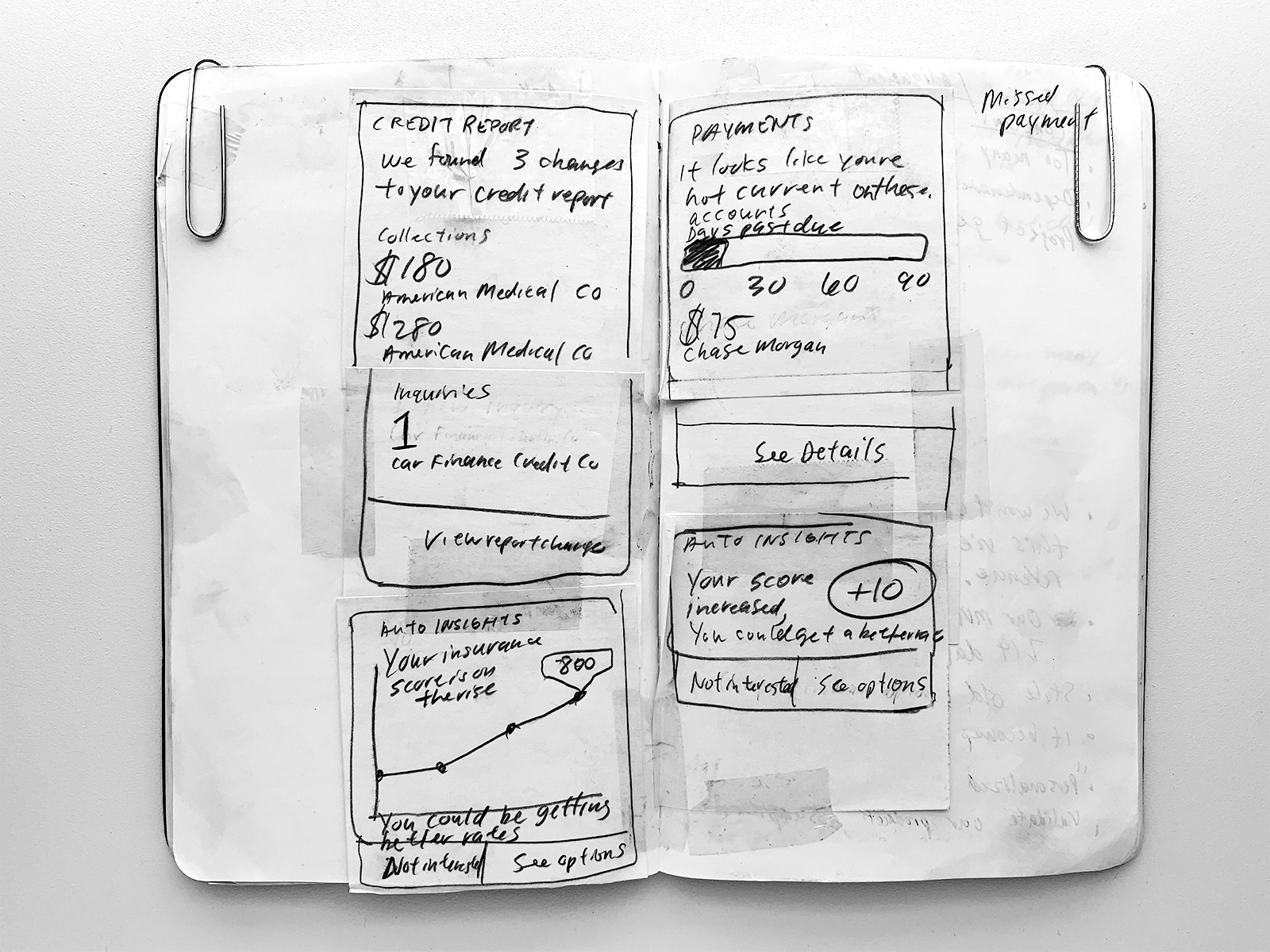

We used the narrative framework along with a set of guiding principles as a way to create conversations and drive value. Our principles included "Put the member in control" and "Inform don't alarm" as well as, cleverly, "Don't make me math", among others.

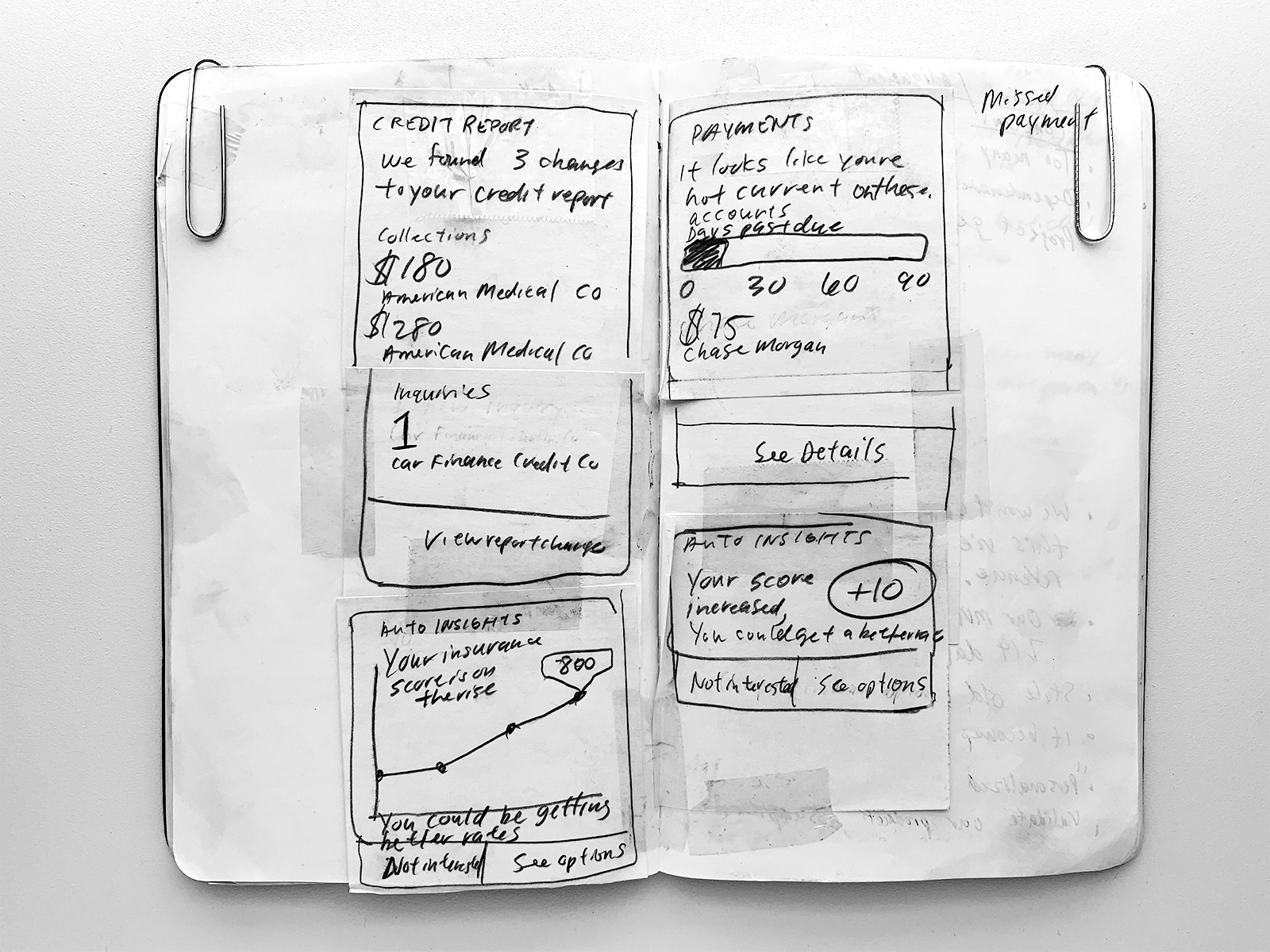

This dynamic content lived on cards with different lockups in the layout. Each card type could be mapped back to a particular kind of narrative or object in the system (OOUX). The Growth and Discovery team organized them into five types: Data Monitoring, Signal, Recommendation, Feature Discovery and Promoted Offers, with the most benevolent narratives like Data Monitoring and Signal having the highest engagement.

Based on a set of criteria or eligibility a group of cards would be displayed on the overview screen along with some that were always present like credit. Each time a user visited some of the content changed. We used data to show users relevant content based on their credit profile or information gleaned from someone's tax return. Along with user intent, propensity models and machine learning the narratives would be ranked in the layout. These narratives acted as a form of content driven navigation.

In some cases we also showed more generic broader content as a fallback, since we couldn't be totally confident and even held some skepticism in the models. Later through research we learned that users appreciated a mix of personalized and generic content.

Finding the right mix of narratives proved challenging. Also coming up with the right templates to fit the content strategy and narrative types ultimately became a very broad discussion within Credit Karma. We had inherited the goal of allowing anyone in the company whether that be a marketing lead, someone from the mortgage team or a product manager to be able to create and experiment with a narrative of their own creation.

The overview screen was widely viewed as a commons, where all entities could be represented and potentially capture user attention, eventually sending them to the appropriate endpoint. Raising awareness about the actions or lack of actions bringing their score down was part of the conversations we were having with customers. "Want to save on auto insurance? Members like you pay $288/mo, a savings of $300 annually". Users mentioned they hired the product to help them find hidden money. Improved credit being the key to unlocking unknown savings.